View this Publication

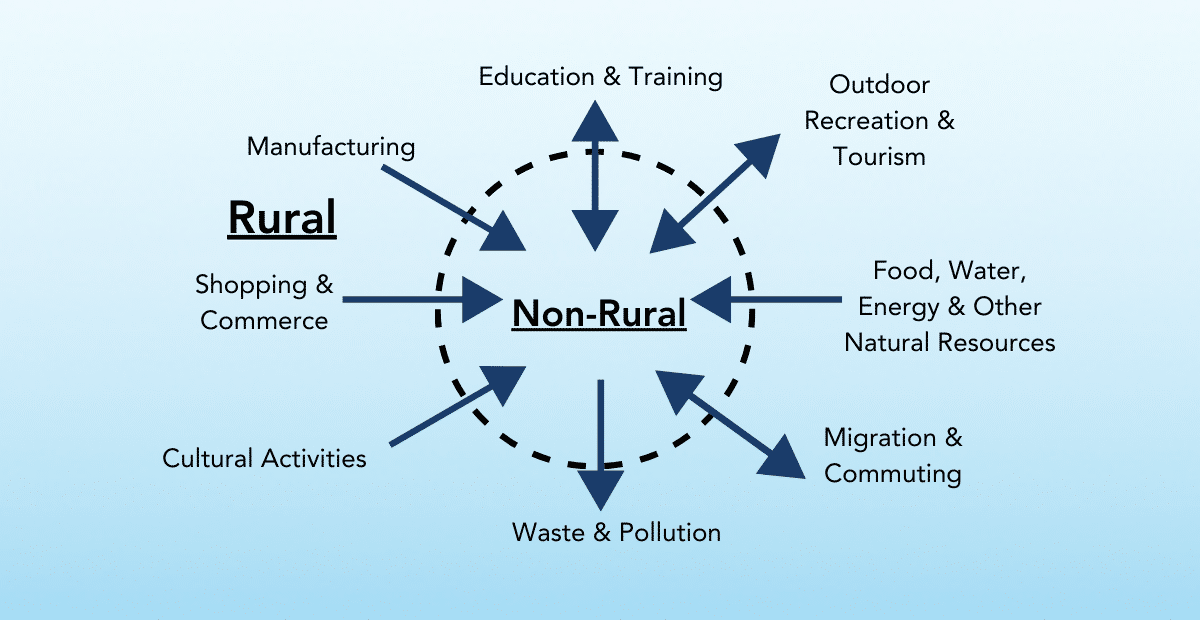

Report seeks to evaluate the impact of financial deregulation on rural commercial credit availability, particularly for small business enterprises. Report highlights the role of Local commercial banks as an important source of capital for small businesses within their local service areas. Findings point to evidence that most small businesses are not affected negatively by changing local financial markets (although author states it is not possible to attribute the positive conditions expressed by businesses to deregulation).

Policy implications include recommendation for regulatory measures to encourage greater bank lending to small businesses, particularly young, start-up enterprises. In addition, author suggests information about commercial lending should be gathered by regulators and made publicly available in order for necessary community partners can understand the functioning of local credit markets and make more informed decisions as a result. This report stresses credit policy as an often overlooked, but critical component of overall rural development policy framework (at whatever jurisdiction)