America’s Rural Opportunity is a six-part series of panel conversations that invites policymakers, economic and community development practitioners, and business and philanthropic leaders to engage in real dialogue around advancing a rural opportunity agenda.

Rural America was front and center in the 2016 national election. Media headlines focused attention on our nation’s acute rural challenges – the decline of critical sectors like mining and manufacturing, technology-driven worker dislocation in those industries and agriculture, inadequate job opportunities for dislocated workers, infrastructure challenges, community health crises, and more.

But a deeper understanding of rural America reveals a companion picture – one where innovation and collaborative local leadership are turning challenges into opportunities. Rather than wait on solutions from outside, many rural places are building on their existing assets and designing creative economic development approaches that drive toward more broadly shared prosperity while creating and retaining jobs.

America’s Rural Opportunity is a six-part series of panel conversations that invites policymakers, economic and community development practitioners, and business and philanthropic leaders to engage in real dialogue around advancing a rural opportunity agenda. The series is presented by the Aspen Institute Community Strategies Group with the Rural Development Innovation Group. Over the coming year, the series will:

- Uncover the complex reality and diversity of America’s rural places, economies, businesses, development intermediaries – and people.

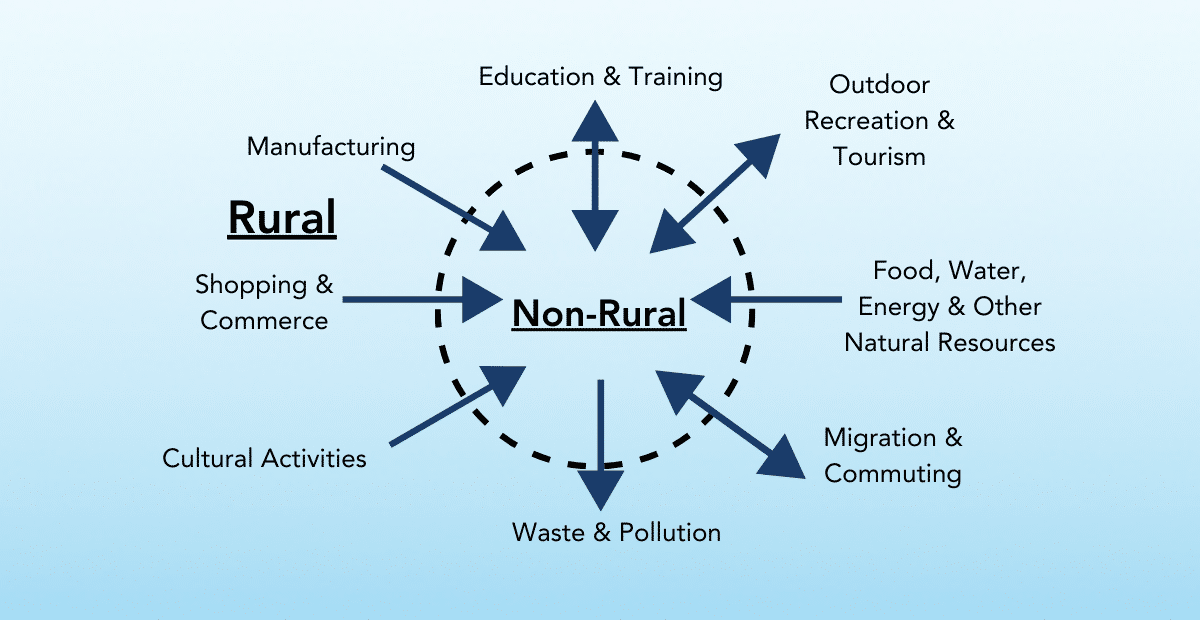

- Raise understanding about what works in Rural America by exploring enterprising economic development approaches that tap a range of opportunities to build wider and more enduring prosperity – and strengthen productive rural/urban connections.

- Identify what the private, public and philanthropic sectors can do differently to improve rural prospects.

The inaugural America’s Rural Opportunity panel will open the series by featuring innovators – business owners, intermediary partners, and investors – active in a variety of rural economies in the U.S.

Speakers

Rural Manufacturing

Contraxx Furniture, McConnelsville, Ohio

Mike Workman, Founder and Owner, Contraxx Furniture

John Molinaro, President & CEO, Appalachian Partnership for Economic Growth

Back in the 1990s, an Ohio furniture maker in the heart of Appalachia noted that most American furniture manufacturers were vertically integrated — which got in the way of producing made-to-order furniture for hospitality and commercial clients. Acting on this market opportunity, he created Contraxx to weave more than 300 independent family-owned and-operated small craft firms, many of them struggling for viability, into a hub-and-spoke system that can produce customized furniture to the clients’ specifications. This distributed manufacturing system takes elements from a co-operative and blends them with opportunist entrepreneurship to help small factories stay in rural communities and employ local people.

Rural Wood Products

Integrated Biomass Resources LLC, Enterprise, Oregon

Dave & Jesse Schmidt, Owners, IBR LLC

Nils Christoffersen, Executive Director, Wallowa Resources

Wallowa County was once one of Eastern Oregon’s major timber producers. The legacy of past harvests, changes in federal land management and decades of fire suppression left this northeast Oregon region’s forests in poor health even as mill closures left its communities reeling. Integrated Biomass LLC, a public-private partnership, is a new economic catalyst in the region, using market-based solutions to help reestablish forest health and create jobs by utilizing the byproducts of regional forest restoration and stewardship projects.

Rural Investment Capital

Tax Credits for Rural Investment, South Carolina

Bernie Mazyck, President and CEO, South Carolina Association for Community Economic Development

Many South Carolina rural places, firms and families are not benefitting from the Palmetto State’s economic prosperity largely because they can’t attract capital to their communities. The South Carolina Community Development Tax Credit – which provides investors with a 33% state tax credit on investments made in certified community development corporations and community development financial institutions – has proven to be a novel and effective tool to attract private capital into these communities, resulting in programs that help low-wealth families build assets and increase their economic standing and prospects.